Lunch & Learn: City Services

Name:

Lunch & Learn: City Services

Date:

March 31, 2022

Time:

11:30 AM - 1:00 PM EDT

Registration:

Register Now

Event Description:

The City provides services such as emergency response, trash collection, and parks to the community on a daily basis, but the services available are more than meets the eye! City staff can assist your business on a wide variety of topics. The City of Grandview Heights is hosting e will hear from the City of Grandview Heights Finance staff on how the 2022 municipal income tax changes could impact tax deductions for you and your business. They will be joined by the Grandview Heights Fire Marshal to cover everything you need to know about fire inspections, prevention, and keeping your business up to date on compliance with the Fire Code.

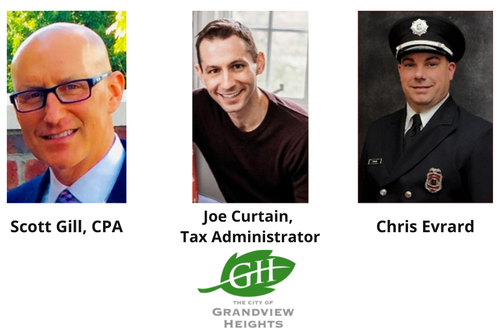

Scott Gill, CPA

Scott has been involved in the public service sector for the past 24 years, including 22 of those as tax administrator with the municipalities of Upper Arlington and most recently Grandview Heights. He began his tax career in 1983 with several stints in public accounting and private industry by serving both retail and real estate entities.

Scott earned his B.A. in Accounting at the University of Mount Union, and his Masters in Tax from Capital University. In addition, he has served on the Regional Income Tax Board of Trustees, the Ohio Business Gateway Steering Committee, and the Ohio Society of CPA’s (OSCPA) State & Local Tax Committee. In 2013, Scott received the OSCPA “Outstanding Volunteer Service Award.”

Scott lives in Grandview Yard and enjoys outdoor activities and traveling with friends and family. You may bump into him on one of his frequent long walks in the Grandview area!

Chris Evrard

Chris, a 20-year veteran of the City’s Fire Division, has been actively in the Fire Prevention Bureau for over 10 years. He has been a Certified Ohio Fire Safety Inspector for 15 years, Board of Building Standards Fire Protection Inspector, and a member of the National Fire Prevention Association (NFPA) for 8 years. He is the lead fire investigator for the City. Chris has not only been an advocate in for both business and code enforcement but has also consulted with businesses in other jurisdictions.

Chris values the inspection process of new construction and remodels as a way to ensure the owner is getting properly installed life safety equipment that will hopefully lead to reduced costs and fewer repairs down the road. While maintenance and repairs can be unavoidable, he makes time to ensure owners are informed and answer any questions they may have. Chris frequently makes recommendations to business owners on unsafe conditions that may be apparent for their customers, employees or the building owner and prides himself on working with business owners to provide a safe atmosphere.

Joe Curtin, Tax Administrator

Joe graduated from the University of Dayton with a degree in accounting in 2007. Joe worked in public accounting for 5 years before working in city tax administration. Joe enjoys spending time outdoors, especially hiking with his wife and two kids. He loves watching all sports, especially the Browns despite the continued suffering it brings.

Scott Gill, CPA

Scott has been involved in the public service sector for the past 24 years, including 22 of those as tax administrator with the municipalities of Upper Arlington and most recently Grandview Heights. He began his tax career in 1983 with several stints in public accounting and private industry by serving both retail and real estate entities.

Scott earned his B.A. in Accounting at the University of Mount Union, and his Masters in Tax from Capital University. In addition, he has served on the Regional Income Tax Board of Trustees, the Ohio Business Gateway Steering Committee, and the Ohio Society of CPA’s (OSCPA) State & Local Tax Committee. In 2013, Scott received the OSCPA “Outstanding Volunteer Service Award.”

Scott lives in Grandview Yard and enjoys outdoor activities and traveling with friends and family. You may bump into him on one of his frequent long walks in the Grandview area!

Chris Evrard

Chris, a 20-year veteran of the City’s Fire Division, has been actively in the Fire Prevention Bureau for over 10 years. He has been a Certified Ohio Fire Safety Inspector for 15 years, Board of Building Standards Fire Protection Inspector, and a member of the National Fire Prevention Association (NFPA) for 8 years. He is the lead fire investigator for the City. Chris has not only been an advocate in for both business and code enforcement but has also consulted with businesses in other jurisdictions.

Chris values the inspection process of new construction and remodels as a way to ensure the owner is getting properly installed life safety equipment that will hopefully lead to reduced costs and fewer repairs down the road. While maintenance and repairs can be unavoidable, he makes time to ensure owners are informed and answer any questions they may have. Chris frequently makes recommendations to business owners on unsafe conditions that may be apparent for their customers, employees or the building owner and prides himself on working with business owners to provide a safe atmosphere.

Joe Curtin, Tax Administrator

Joe graduated from the University of Dayton with a degree in accounting in 2007. Joe worked in public accounting for 5 years before working in city tax administration. Joe enjoys spending time outdoors, especially hiking with his wife and two kids. He loves watching all sports, especially the Browns despite the continued suffering it brings.